April is Youth Financial Literacy month!

At Canopy, we love empowering each generation to learn how to use money - especially our kiddos! As your local credit union, we want to equip parents and kids to grow in their money skills. Financial literacy is a big topic, but with intentional planning and purposeful follow through, kids can learn in leaps in bounds!

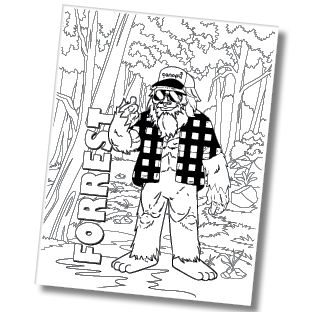

Enter the April 2023 Coloring Contest!

Dowload the coloring sheet and application form!

Dowload the coloring sheet and application form!

The winner chosen will receive a visit from Canopy’s mascot, Forrest the Money Sasquatch. While your child is coloring, explore different financial questions:

- What is something you want to buy?

- How can you save up to buy that?

- What are some things that you need?

- What are some things that you want?

What is financial literacy?

Financial literacy is defined as being the ability to weigh the pros and cons of a money decision and confidently choose what to do. The skills to make money decisions take time to build up, but starting when your kids are young will help them start growing. Researchers from the University of Cambridge found that at the age of seven, kids have developed many of their money habits.

Don’t worry though, helping your child become financially literate doesn’t mean they need to know EVERYTHING about money. Instead, it is about knowing what questions to ask in order to make a wise decision.

While you shouldn’t expect your kids to instantaneously understand the ins and outs of saving for retirement, planning for a house down payment, or diversifying a portfolio, there are multiple ways to introduce financial concepts to help them better grasp this important part of life.

Practice makes perfect

Kids need hands-on experience to build up their money skills, according to a recent study published in Family Relations. Talking about using money isn’t enough. Just as in other areas of parenting, telling a child something often doesn’t work as effectively as letting them experience it.

It can be intimidating for parents to know where to start with incorporating money lessons. However, since money is a part of daily life, there are many creative ways to include kids into decision-making processes. For example, while at the grocery store, engage your kids in helping you find the sale tags. Or, give them a $10 budget to get three items of their choice.

Other practical ways to grow financial literacy include:

- Play games! Games like Monopoly, The Game of Life, Catan, Acquire, Cashflow 101, et

- c. give kids the opportunity to yield their own cash and make decisions that have consequences.

- Media as a teaching tool: Go to the library and check out books about using money. Watch shows featuring entrepreneurs and business owners. Point out conflict in movies that are over money.

- Encourage part-time gigs: When your kids are old enough, help them explore ways to make extra cash. Extra chores around the house, helping an elderly neighbor, selling crafts, or babysitting are all ideas to start with.

- Tax your kids a little: This unique approach may not be one your child is as thrilled about. But, it will go a long way about teaching them what to expect later in life. The hard truth is that we don’t get to keep everything we earn. Just as the government collects taxes on your income, think about ways you can withhold money too - but instead of taking it maybe put it in a savings or investing account for your child.

Talk about it

While talking about money isn’t enough, it is still an important thing. Incorporating age appropriate conversations about money will kick start your child’s understanding of money. As an adult, work to evaluate how you speak about money. You are their role model in so many areas, including finances. When it makes sense, talk to your kids about where the family stands financially. If things are tight, it might help to have that conversation with the whole family because then kids will understand when you have to say no.

Additionally, it is crucial to teach kids to ask questions about money. For example, how much will this cost? How can I save up for what I want? If I use my money for this, what will I have to give up? What will I gain? Building up these decision skills will help them when they encounter financial questions that are new.

Besides stronger decision-making skills, the quality of financial education kids at home also has been found to also positively impact mental health for young adults as well as quality in young adults’ romantic relationships.

Take the month of April to lean into being more international about talking about money with your kids and practicing their skills. These fundamental lessons will set them up for a future full of success!